Unveiling the Secrets: Compute The Genuine Home Loan Expense

Acquiring a property stands as one of the most financial decisions you shall possibly make, and grasping the true cost of your loan stands as crucial to maintaining your long-term economic health. While many people primarily look at the monthly payment, the truth is that your mortgage also comes with a variety of other costs, including loan interest, home insurance, property taxes, and potentially private mortgage insurance. To manage this intricate landscape, it is necessary to have the adequate tools and expertise at your disposal.

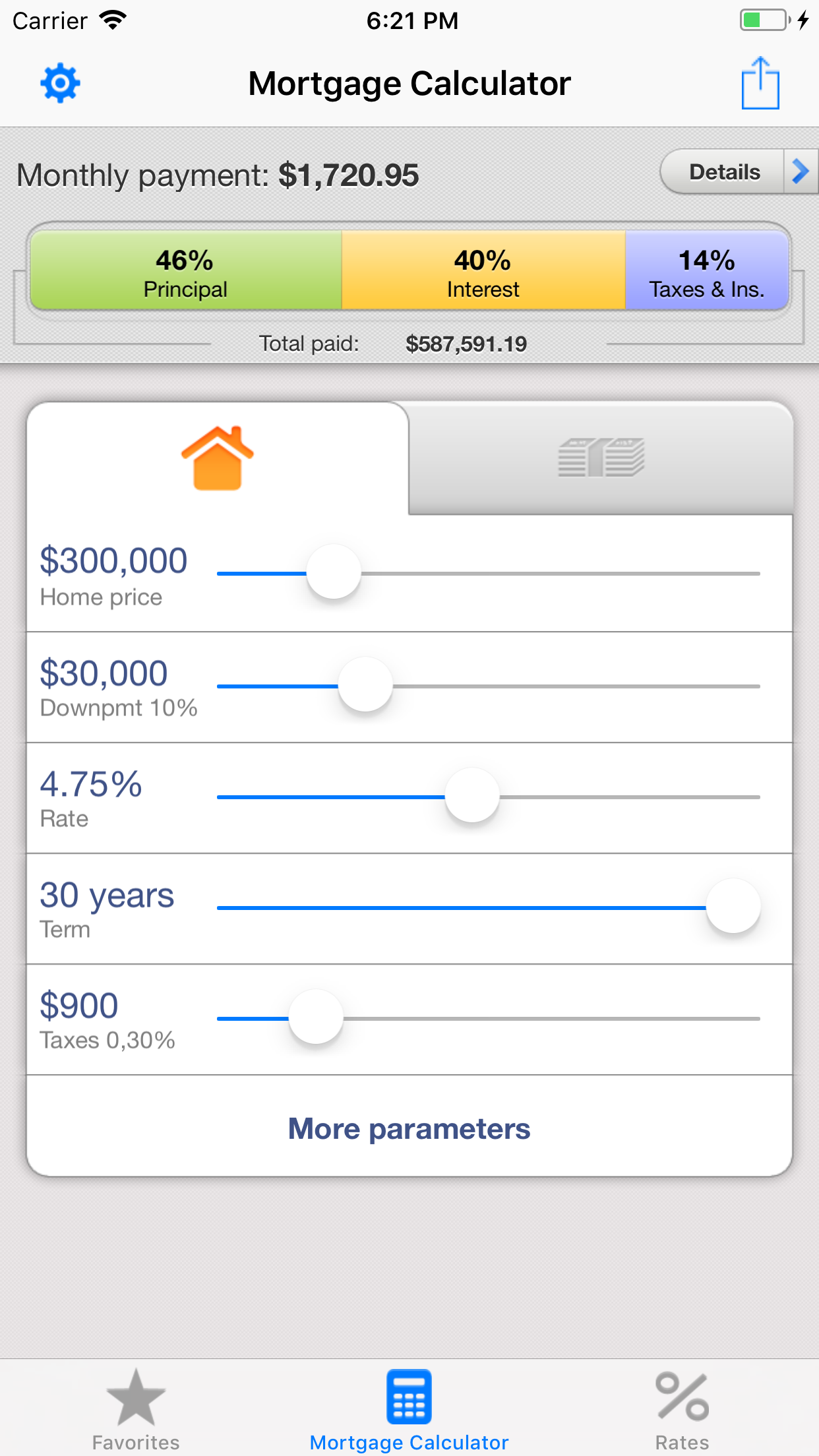

The good news is that you don't have to tackle this intimidating task alone. With a mortgage calculator, you can streamline your calculations and gain a more transparent picture of what you can afford. By entering key financial information, such as mortgage amount, interest rate, and loan term, you can reveal insights into your true mortgage cost. Understanding these factors will equip you to make educated decisions, assisting you find a mortgage that matches not just your current budget but also your upcoming financial goals.

Comprehending Home Loan Fundamentals

A home loan is a loan exclusively used to buy real property, where the property serves as security for the loan. Borrowers obtain money from lenders with the agreement to repay the principal, plus interest, over a defined term. Mortgages come with a variety of conditions, typically from 15 to 30 years, allowing borrowers to opt for a period that fits their financial situations.

Interest rates play a vital role in affecting the overall expense of a home loan. Fixed-rate mortgages maintain the same rate of interest throughout the loan period, while variable-rate loans have interest rates that change based on market conditions. Comprehending how these interest rates affect payment schedules can greatly influence a borrower's decision-making and long-term budgeting.

In alongside the main amount and financing costs, mortgage applicants must also consider additional expenses associated with a home loan. These can include property taxes, homeowners insurance, and private mortgage insurance if the down payment is below 20 %. It's crucial to factor in these additional costs to achieve a full picture of the actual expense of the loan and avoid any financial surprises down the line.

How to Use a Home loan Calculator

Using a mortgage estimator can significantly ease the process of determining your actual home loan expenses. To start, collect all the essential information about the home loan you are looking at, such as the loan amount, rate of interest rate, and the mortgage term in months. Inputting this data into the calculator enables you to see the estimated monthly costs. HipoteCalc is often the initial step in evaluating whether the home loan fits within your financial plan.

Once you have your monthly payment cost amount, explore further features of the calculator. Many calculators enable you to input property taxes, home owner's insurance, and even individual mortgage insurance. This supplemental data provides a more complete view of your total monthly housing costs. With understanding these amounts, you can more effectively gauge the affordability of the home loan and make smart decisions.

In conclusion, use the estimator to try out with various scenarios. Change the loan amount, rate of interest rate, or loan term to see how these changes impact your monthly payment payment. This ability to modify helps you understand the effect of various possibilities, for instance making a larger initial payment or choosing a shorter loan term. Through assessing these options, you can unlock insights about your financial situation and choose the mortgage that works most effectively for you.

Elements Influencing The Overall Mortgage Expense

A number of critical elements impact the total expense of the home loan. One of the most significant is the rate of interest. Home loan rates can vary based on market conditions, the financial institution's policies, and the borrower's personal financial profile. A lower interest rate can save you thousands of dollars over the life of the loan, while a elevated rate can substantially increase your monthly payments. It is essential to compare options